The biggest scam you've probably never heard of: Shoddy Goods 006

4

Hey, Jason Toon here with another Shoddy Goods, all about the stuff people make, buy, and sell. It’s incredibly rare these days to find a policy issue that consumers of all political persuasions can agree on. But here’s the story of a taxpayer-funded swindle so outrageous, it unites left, right, and everybody in-between.

Let’s say the government was handing out cheap loans that you could invest in whatever you want and keep all the profit. And furthermore, let’s say they promised to bail you out on any other debts you defaulted on, so you’d be a very attractive risk for other lenders, giving you even more access to cheap capital.

You could probably make a pretty tidy profit. And you’d probably be loath to give that gravy train up. But hey, this is just fantasy, right? Nobody gets that sweet a deal.

Nobody, that is, except the Federal Home Loan Banks (FHLBanks) and their 6,000 member banks and insurance companies. A Great Depression-era program meant to help more Americans afford houses has turned into an all-you-can-borrow buffet for buccaneer investors. And now that these government-sponsored entities are under more scrutiny, FHLBanks are fighting being held to any higher standards.

The Beal Bank branch in Las Vegas, home of some of the biggest action in town.

You got to know when to fleece 'em

In a time of skyrocketing housing prices and tightening credit, it sounds like a promising idea: government-backed banks that provide liquidity for financial institutions to invest in housing.

Those institutions get cheap credit and the assurance of federal backing. Aspiring homeowners get access to more mortgages. And there’s more investment in new rental housing. So more homes of all kinds get built and price growth cools off a little. Everybody wins, right?

Well, that system has existed in the U.S. since 1932 in the form of FHLBanks. And unfortunately, it doesn’t work that way anymore. At all.

FHLBanks refers to 11 government-sponsored banks around the country that serve some 6,000 member institutions like banks and insurance companies. This includes lots of small community lenders, but also the nation’s biggest financial institutions, your JP Morgan Chases and Wells Fargos.

To join, an institution does have to prove they’re involved in financing a certain amount of housing. But once they’re in, they’re in. There’s no ongoing test for membership in FHLBanks. While some larger member banks have to meet some standards for supporting housing, most are exempt, says the Consumer Federation of America.

So a lot of savvy investors have set up tiny banks on paper just to get at the FHLBanks trough. A 2023 Bloomberg investigation found that of the FHLBanks’ more than 6,000 member institutions, 42% had issued no mortgages at all for the previous five years. Instead, they’ve used that cheap credit to invest in everything from cryptocurrency to Hollywood mansions.

In one case, Texas banker and Texas Hold 'Em champ Andy Beal tapped some $4 billion in government-backed credit to bet on various securities, even while his Beal Bank’s home lending activity shrank to just 1% of the bank’s assets. Another supposed community housing bank reportedly issued a mortgage to an aspiring Californian homeowner named Johnny Depp. Yes, that Johnny Depp.

It takes a pirate to know a pirate.

Oh, the FHLBanks themselves are doing alright, too. The CEO of the FHLB of New York made $2.3 million in 2022 while paying a sweet dividend of 9.5% to their members, some of the biggest banks in the world.

FHLBanks members are required to contribute 10% of their profits to an affordable housing fund. Some have voluntarily contributed 15%. But from 1989 to 2011, FHL Banks contributed an average of 30% of profits - profits that were made by investing our money, remember.

This year those contributions will amount to about $1 billion. Maybe it’s just me, but that seems like a paltry return on the public’s $7 billion annual investment in FHLBanks.

Wait, how is this legal?

Well, let’s start with the fact that most Americans have no idea that FHLBanks exist. And that’s how FHLBanks likes it. You won’t see them sponsoring any college bowl games or TikTok influencers. The Federal Home Loan Banks Wikipedia page is only 1,000 words long, shorter than the entries for Moe Szyslak or corn dogs. So public pressure to fix them has been almost nonexistent.

This hustle is also a relatively recent development. Things really started going wrong around 2012. In the wake of the global financial crisis, investors on the fringes of the mortgage market were looking for new, lower-scrutiny sources of cheap credit. A wave of phony insurance companies was the first ploy; those have been barred from FHLBanks since 2021. But those changed the perception of what you could get away with as a member institution. And regulation is still catching up to the problem.

Now that FHLBanks is getting more attention, though, voices left and right are calling for change. In fact, I couldn’t find a single commentator speaking up for the current FHLBanks system, other than the banks themselves.

Some want to reform FHLBanks to serve its intended role. Just this month, liberal think tank the Urban Institute issued a report acknowledging that “The FHLBs are an indispensable source of support for the housing finance system.” But they recommended cracking down to ensure “that those eligible for membership cannot wind down their support for housing finance once admitted.”

The Brookings Institution also calls for a renewed focus on the original mission, including limits on permitted investments, executive pay structure, and use of lobbyists. “By restoring their original purpose while mapping onto the modern financial system,” say authors Aaron Klein, Kathryn Judge, and Alan Cui, FHLBanks "can promote access to affordable housing while reducing financial stability risk and taxpayer exposure.’

The laissez-faire Cato Institute goes further, arguing that the entire FHLBanks system be abolished: “To reduce the risks both to taxpayers and the broader financial system, the FHLBs should be privatized, if not eliminated.”

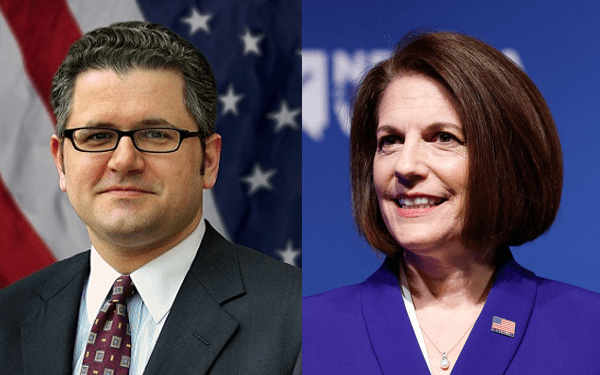

Mark Calabria is the Republican former head of the Federal Housing Finance Agency (FHFA) under the Trump administration and former chief economist for Vice President Mike Pence. Calabria said to Bloomberg, “Is the membership broader than it needs to be, and does it facilitate lots of activity with little social benefit? It does, and that’s a problem.”

“Does anyone NOT agree with that?”

As momentum for reform builds across the political spectrum, FHLBanks and their members won’t give up their special arrangement without a fight. Late in 2023, the FHFA, which regulates FHLBanks, announced their intention to issue new rules ensuring that FHLBanks members fulfilled the housing mission - remember, the whole reason they get taxpayer backing at all.

This month, FHLBanks members fired back with letters of comment that denied that FHFA had any right at all to tell them what to do with their money (again, really our money). They say that’s Congress’s job. “Congress is the one that draws the box,” said the president of the Council of Federal Home Loan Banks.

Mark Calabria and Catherine Cortez-Masto don’t agree on anything - except FHLBanks.

They might want to be careful what they wish for. When FHLBanks came up during a January hearing of the Senate Banking Committee, it… didn’t go well. Sen. Catherine Cortez Masto (D-Nev.) grilled the CEOs of the eight largest banks in the US (all big borrowers from FHLBanks) on whether FHLBanks should be required to raise their housing fund contributions to 20%, and be held to stricter housing finance requirements. Silence.

“Does anyone NOT agree with that?” Cortez Masto asked. Again, no response. “Good, all right, good start!”

For now, that gravy train still has some ways to run. Action seems unlikely between now and the November elections, and the future beyond that is anybody’s guess. At the very least, though, more and more people are getting wise to the hustle. Like me. And now, you. As the Senator said, good start.

Huh, I did not expect Johnny Depp to show up here (though now I’m hungry for corn dogs). Had you heard of this FHLBanks stuff before? Got any thoughts? Join in on this week’s Shoddy Goods chat in our forum!

- Dave (and the rest of Meh)

Meanwhile, if you’re new to Shoddy Goods, enjoy our past issues.

- 5 comments, 15 replies

- Comment

I knew about that scam, and the way it bites everybody in the ass except the greedy bastards who place the loans, sell them off to other people who ought to know better, and remove themselves from the chain of responsibility before the defaults start to happen.

@werehatrack yeah, that’s what happened in 2008. That method of screwing everyone has currently been removed by making documentation requirement much more stringint on the buyer.

I just finished working for FHLB in Irving. I have no obligations to them. Here’s what I know:

@festercluck FHLB was created by the US Government to further home ownership by making access to credit easier. FHLB isn’t taxpayer funded. Its funded by the investments of its members. All member banks buy shares to join FHLB, and act as the initial security of the institution with the bank. That said, members do have to constantly adjust collateral with the bank depending on how much they borrow.

FHLB itself can only spend, invest, and give money for activities related to furthering home ownership. This is so strictly followed they won’t even sell old equipment to the second hand market. Member banks borrow money and can essentially do as they will with it. They are members, so they can request a broad range of banking services. FHLB in fact provides liquidity to many member banks when shit hits the fan. It also, in essence, acts as a shared IT center for parts of the bank to bank economy. FHLB does also invest in securities of various sorts to fund itself and to pay its dividend.

FHLB does offer programs in which they essentially loan money to the bank low to no interest which has restrictions around it to soley use for qualified home buyers. I personally bank with a member institution. I found it impossible to access any of those programs. This is because while FHLB may offer the support, no bank is required to offer those sort of loans, and in fact every institution I spoke with saw loans that utilized that support as undesirable for “other reasons”. I’ll admit to having had poor credit for years. Once I remedied that situation, to the exact FICO 5,4, & 2 necessary, banks wanted to talk about other assistance programs.

I believe the problem is that housing loans compete with all the other loans the members can take. The housing products dont generate them as much profit.

FHLB is assumed to be backed by the faith and credit of the US Govt. However, that is neither used nor actually a fact. Its a dirty secret that the US Govt could just tell FHLB to screw off. They dont insure their accounts any more than yours or mine.

FHLB can be seen in many ways like Texas Unemployment insurance. Members invest and have a lender of last resort. In the end one must remember: FHLB is a private institution which is highly regulated by the government, not a public institution.

Oh, and FHA most definitely sets the rules for FHLB. That’s what Congress set up. FHA sets policy, FHLB executes policy. To say Congress sets the rules, while ultimately true, Congress delegated that power to FHA.

@festercluck And notably, at least twice in the relatively recent past, Congress has mandated the issuance of subprime lending for mortgages for people with no credit history or a poor credit history. There have been other banking rule changes and mandates which have been at least equally disastrous over the years, one of which caused the failures of large banks in substantial numbers. My ex-wife profited greatly from being a bankruptcy attorney for a firm that had the FDIC as a client back in the '80s and early '90s. The results of those various micromismanagements by Congress are well known to some of us.

Super interesting @festercluck, thanks!

@werehatrack I will point out that Im not against the federal government stepping in this situation, but I’ll agree that their efforts have had mixed effects. On the whole it doesn’t appear it has been as effective as it was meant to be. It also doesn’t appear that the money is being used in the spirit it is meant to. The biggest problems I see are mismatched credit overlays and the lending industry conveniently not updating themselves on rule changes, sometimes for years. For instance, some assistance programs use an average of credit scores when having a cosignor. Almost every lender Ive spoken to doesn’t know that, and will try to correct me on it. We’re talking Freddy Mac programs.

If the federal government is going to do this sort of thing, it has to be carried through all the way to the buyer. I dont have a solution in mind, but in my experience what is available now just gets priced into the system and doesnt actually benefit the buyer much more than a half-opportunity, and more likely a drained down payment fund.

@festercluck @werehatrack I think the obvious conclusion from reality is that the worst system for regular people is “things mostly run by private institutions with the government half-assedly mandating control over it.” Healthcare, all kinds of insurance, housing, etc. are all an absolute mess in the USA, worse than most other places that don’t simply lack resources, because for some reason the USA compromise between “small government” and “useful government” is “half-assed government with its incompetent underfunded corrupt finger in everything.”

Other countries healthcare generally serves the people better (I know USA folk thing the British NHS sucks but that’s half weird propaganda, half “yes it’s true that it’s not great but it’s not nearly as bad as the USA system which costs more to deliver less”).

Proper social housing when countries have it functions much better than “rent control” ever has, and no control would also be better than the US system of “we add so much bureaucratic overhead that people are almost obliged to charge more for housing than it should be, and the government is actively hostile to renting for below market rate for some reason.” At least inexpensive ramshackle slums or overcrowding being a legal option would make survival not a choice between “being homeless and treated as a criminal” and “paying too much”, which combination leads inevitably to the daft situation we have now: the price for housing settles at the absolute highest amount that people can afford. Great for people who already own land, terrible for everyone else.

To be clear, I’m not a proponent of big government or getting rid of government, I’m just in favor of not instead doing the absolute worst compromise between the two. Though I’m probably a bit more big government, in that I think having multiple intermingled for-profit cellphone & internet providers is a much worse idea than nationalizing that shit (but again, other less terrible compromises are also viable, just for some reason the USA always picks the worst compromise it possibly can!)

@ravenblack I will point out that the UK NHS does not serve all citizens equally. While the service provided to most of the general public is far better than even the US fully-insured will reliably see, certain types of care are next to impossible to get, and certain population segments are underserved or outright deprecated into a queue that only grows longer. Unsurprisingly, some of those people tend to be underserved or disparaged here by design as well. (I’m in one of those groups.)

@werehatrack 100%. NHS used to be better, too, but has been pretty badly gutted over the last ~10 years by successive governments that were actively trying to make the system more like America’s, presumably for their own benefit not for the benefit of any actual human people.

That said, the US system also suffers from ever-growing queues and lack of availability somehow, even if you’re paying cash (which is also typically going to cost an order of magnitude more than the same treatment for cash would in the UK or Australia). I don’t have any explanation for how that’s happening. People in the US who believe the weird hype that the healthcare here is the best because you can theoretically get high-end experimental treatment are, as far as I can tell, people who haven’t actually tried to use healthcare services at all.

following

Just another example of why the federal government is rarely the answer

@allergycheryl The real problem is that for a great many problems, the only answer is one that can only be provided by government. And if government does a bad job, things go wrong.

@werehatrack I didn’t say all government. I said federal government. The layer of government most removed from the people that they serve

@allergycheryl My statement continues to apply. Local and state governments can only address local and state-level problems, and sometimes they refuse to address things that need to be done, because they just don’t want to. Every state has examples of this, and some states still go out of their way to avoid addressing problems they wish to ignore - sometimes ones that they actively want to make worse.

And private industry is the generally the answer for rich people making themselves richer (while not actually helping that much, if at all). The stereotypes swing both ways.

And tangenting off of @werehatrack’s comment, the government is also often the only possible answer to many situations. If the government went ‘poof’ like libertarians want, the entire economy (and perhaps world economy as well) would collapse, and not come stabilize for a long time.

Hm, I got the email and wanted to link it for someone else to see, but apparently that’s not possible, and by the time the link exists I won’t remember. Not sure about this publicity strategy.

@ravenblack You should be able to share the link from the top of the newsletter that says “View this email in your browser”

@ravenblack And now you can send them here.

@ravenblack We’re working on it!