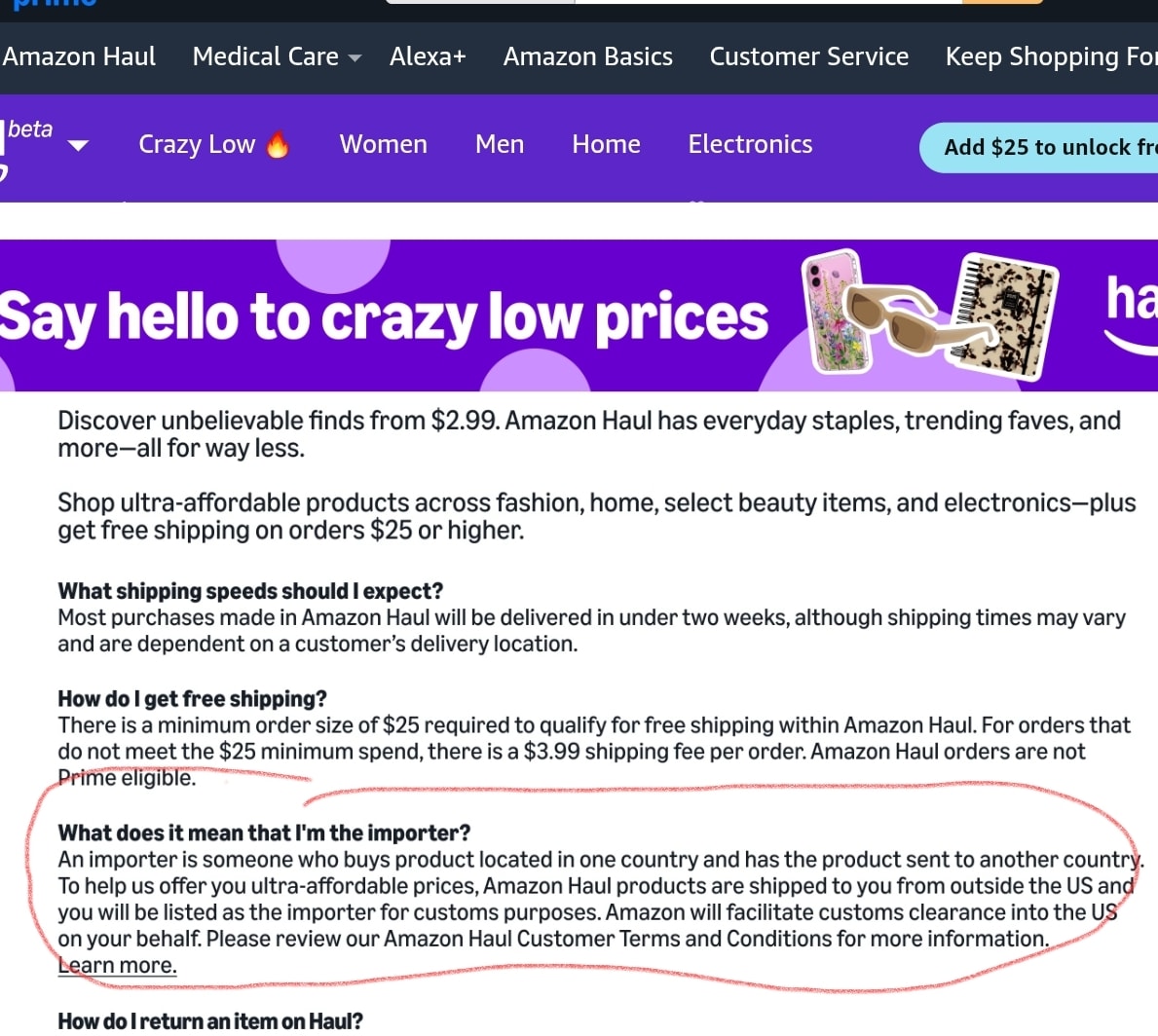

Amazon Haul.. what does that imply?

7While checking my Amazon account today an announcment came up having to do with Amazon Haul. This seems to be designed to compete with Temu et al. As you can see from the screenshot this lists YOU as the importer (I haven’t used Temu so I’m not sure how they classify you).

Under the “learn more” link it says you are responsible for the fees, customs etc. Does this mean you’ll get stuck with a bill for any tariffs (which are generally paid by the importer)? Will you come back and get re-billed (at a different price) in order to cover that fee? How would you know what it’s going to be before you place your order? Will it be paid through your Amazon account or directly to a billing from the US government?

So many questions!

- 12 comments, 54 replies

- Comment

Looking into it (I don’t use the app so had never heard of it, Amazon will do one of two things - you pay all on some products, or you pay a flat fee in advance on some products and get refunded the difference if you pay too much (couldn’t find if you pay more if you underpay their flat fee in advance).

This is how I interpret it:

“We are unable to predict what the tariff will be on imports from one day to the next, so we don’t know what any item/s will actually cost you. We are “allowing” you to act as the importer so that we can state a price (which we will collect and from which we will take our fee) and let you deal with the tariff when the item arrives at your post office. You will have to pay the tariff ( be it 10% or 150%) to claim the shipment.”

This was how things worked in the past when there were restrictions and tariffs on imports. The seller/sender had to fill out a declaration of content/value that was placed on the shipping box next to the address. The Postmaster had to collect the tax by check/credit card based on the value stated on the box. I remember doing this in the '70s and '80s. I also remember senders getting a bit “creative” describing the contents/value of the package.

But - who knows? I’m unsure what “facilitate customs clearance” means for this stuff.

@rockblossom

My guess is that it means that Amazon will do as little as possible for you to still follow customs regulations and as much as possible to avoid paying any customs fees or taxes. In other words, “Here are some forms we filled out because we had to. If you have any questions, call somebody else. Buh bye!”

@ItalianScallion I noticed that Amazon will accept returns on eligible items and will refund the selling price when received. Whatever you paid the gov’ment in added taxes/tariffs is your problem. And since any tariff has already been paid, Amazon is free to resell the item for whatever it can get for it.

@rockblossom Now that’s sneaky.

@ItalianScallion Did a bit of research. Amazon may be taking advantage of:

Source: https://www.china-briefing.com/news/us-trump-tariffs-key-implications-for-chinas-ultra-fast-fashion/

So maybe there will be no tariff for stuff shipped directly to the “importer” of these, and if any are returned to Amazon, they have neatly evaded the extra tax by not importing in bulk. Or the “de minimus” charge will be in effect, and the buyer will still have to pay. Who knows what will be in place on Monday.

@ItalianScallion @rockblossom The De Minimus exemption for parcels with a value under $800 is explicitly eliminated in the up-again-down-again-maybe-104% fiat tariffs, so even something that’s $3 gets nicked for the tariff, and possibly for a customs broker fee (typically not less than $25) and maybe a bonded warehouse handling fee (could literally be anything) and a COD fee (possibly another $25-$50) on top of all of that. USPS has stated that for small-value parcels, the on-top-of-tariff fee will be $25 inclusive.

Bottom line: Until it becomes clear that the administration has decided to concentrate on fucking up something else, and restores the old (saner) policies, juststay away from Temu and Shein and Wish and Haul for anything that’s ship-direct from China.

@ItalianScallion @rockblossom

https://www.whitehouse.gov/fact-sheets/2025/04/fact-sheet-president-donald-j-trump-closes-de-minimis-exemptions-to-combat-chinas-role-in-americas-synthetic-opioid-crisis/

@rockblossom @werehatrack I’m guessing that all along I’ve been considered the importer when I buy something that ships from another country directly to me and that the de minimus exception is what has made it so that I don’t have to file any paperwork and pay import duties. In December I was surprised to find that two gifts I ordered were shipped to me from China. Now I’ll have to pay more attention and/or ask the seller about shipping. I guess I’ll find out about all this soon since I ordered an antique military-issue type of coffee maker and it’s shipping to me from Ireland, which I didn’t realize when I ordered it.

@rockblossom the post office, UPS, FedEx, etc will do manifest clearance for their plane as it arrives into the US. They are currently allowed to do this. Clearance will be based upon the declared value the sender listed in the commercial documents included with the shipment.

The issue w the manifest clearance is that it is riddled w errors and is why most large companies do not allow the carriers to clear their goods. W Fed Ex, for instance, you can select BSO (broker select option), where Fed Ex does a document handover (for a fee) and holds your freight in a bonded area until your broker provides released 7501/3461 documentation. At that point the shipment is removed from thr bonded hold and delivered. UPS has something similar, I just dont recall what its called.

With the removal of the de minimus exemption a clearance will still be done as in thr past, but you will likely be subject to duty (unless your item is duty free or has chapter 98 exemptions), and of course there will be tax charges. I THINK the minimum is something like $25 now, but its been a long while since I’ve handled or oversaw brokerage at a company.

And apparently there is mass confusion in the brokerage world given all the changes happening at lightning speed. Charges should be incurred based upon the rule in effect the day the shipment departed origin, so wheels up for air freight or departure from the port for ocean.

@rockblossom @werehatrack I spoke too soon. After having read the reference werehatrack posted linking to the White House’s statement on the de minimis exemption changes, I now realize it applies only to China and Hong Kong. At least I know now that things under $800 that are shipped from Europe directly to me are still exempt.

@rockblossom @tinamarie1974 USPS had an advisory posted last week stating that the de minimus would be entirely gone as of May 2nd, and the minimum combined duty and COD fee would be $25. On April 8th, the administration tripled down on that and bumped it to $75. (YEOWCH!) What’s not explicitly stated in the (sloppily written, IMO) order is whether the $75 is a minimum, or whether the remitter has the option of paying at the ad valorem rate (90%) for items whose value is below the point at which it would be $75 if paid ad valorem ($83.34). My reading of the April 8 EO seems to indicate that the $75 may be the de minimus flat rate, with the duty assessed ad valorem for $83.35 and above. I think that $75 is almost certainly the minimum rate, but I’m not a mind reader (nor do I want to be, where this is concerned). It appears that there is still a good bit of confusion.

OBTW, unless the tariffs get paused again, the de minimus for China jumps to a ludicrous $150 in June.

More info:

https://www.inc.com/jennifer-conrad/iits-official-the-duty-free-exemption-on-small-shipments-from-china-expires-may-2/91171380

https://www.whitehouse.gov/presidential-actions/2025/04/amendment-to-recipricol-tariffs-and-updated-duties-as-applied-to-low-value-imports-from-the-peoples-republic-of-china/

@rockblossom @werehatrack the $25 doesn’t make sense as there is a minimum tax rate on top of duty, however I doubt that the folks writing these alerts are always SME’s. Unless thr $25 was their fee on top of the government levied charges.

Also as I said, the brokerage community is besides themselves given all the changes, delays, etc that are being announced on what seems like a daily basis. Believe me when I say no one is clear on the legal path forward and everyone is trying to wade through all the changes.

I think we all need just wait for the dust to settle and see where everything ends up while understanding that any purchases made from the targeted countries may incurr duty, tax and potentially brokerage related charges. One needs to decide if that purchase is worth it, and it likely isnt.

And if you are interested, here is a really good article that delves into the three types of entries that can be filed and their requirements. It also talkes about the origins of de minimus

https://www.cato.org/blog/high-costs-eliminating-de-minimis-shipping

Yeah. What a clusterfuck. I would have to assume that this has been in the works for a while. Not sure when this actually launched, having only noticed it today, but this is not a program that would roll out overnight. I’m sure there’s a bunch of heads at the 'zon exploding right now.

@chienfou It launched a few weeks ago with a delayed imposition date of 5 April.

If you had stuff already on the way that hasn’t shown up, prepare to need lube.

@chienfou Yeah. I think the 'Zon Haul program was in the planning stage last year, thinking they could take advantage of the same small-dollar exemption used by Shein/Temu/et al - which is not there now. There will probably be people who will think: “But it’s Amazon, an American company! I can order for them without a tariff!”

@chienfou @rockblossom Sounds like Amazon is fully embracing the overseas junk-makers in their third-party sellers program, rather than maybe just tolerating it for the sake of making a buck.

@chienfou @ItalianScallion @rockblossom Amazon has a lot of Chinese sellers (who are not always obviously Chinese). They probably want to keep the business, but definitely want to pass on the tax to the buyer.

@chienfou @rockblossom @user98378149 I read a couple of articles from April 8th that said that in response to the uncertainty over tariffs, Amazon is restructuring their Haul program to focus on low-priced goods already in the US, usually well-known brands, rather than the no-name stuff they originally set out to promote and sell, and low-priced US-made goods.

@chienfou @ItalianScallion @rockblossom @user98378149 I suspect that present-in-the-US China-origin goods will get bumped in price dramatically as the tariff date approaches.

Or the administration could declare Great Victory and drop the whole thing again, further increasing the uncertainty levels.

Either way, this whole mess is idiotic.

@chienfou @ItalianScallion @rockblossom @user98378149 @werehatrack or before that. Companies are scrambling to both import and export goods between the US and CN right now. Air freight rates have increased from less than a dollar per kg to $7-$10/kg because of elasticity of demand. The airlines are laughing all the way to the bank and its the consumer who will suffer.

I was speaking with one of my forwarders the other day and they had customers chartering planes to avoid the higher duty rates. In case you are curious, the last time I looked at chartering a plane it was around $200k.

OBTW, about the synthetic opiod crisis that the tariffs are supposed to stop, ICE has been employing detection methods to catch incoming small-parcel fentanyl shipments all along, and that is not how most of it arrives in the US. The vast majority coming direct from China slips in via inclusion in tightly-sealed hidden packages concealed in large shipments of legit commercial goods, which these tariffs will do zip-zero-zilch to interdict.

And here’s a bit of advice that I hope none of you need: STAY THE FUCK AWAY FROM THAT SHIT. THEY CALL IT “THE ONE-DOSE ADDICTION” FOR GOOD REASON! Late last year, I was given fentanyl as part of the waking-anesthesia cocktail for an angiogram, and the emotional crash when it wore off was FUCKING INTENSELY BRUTAL. Anyone with an addiction-susceptible neurology or existing suicidal tendencies would have been ready to kill to get another dose. I recognized the withdrawal for what it was, and I vowed to NEVER allow that crap to be administered to me again.

@werehatrack It sounds like you made it out of that disturbing experience ok and I’m so glad to hear that. I find it hard to believe that fentanyl is used with humans knowing the high risk of addiction.

My bad experience was with oxycodone, i.e., Oxycontin, that was given to me for at least a couple of weeks after major surgery and damage to my body after a porch collapse accident. While taking it, I had terrifying recurring nightmares that more than ten years later I can still recall in every tiny detail. Oh, and hallucinations and mindbending so bad that I could not make sense out of an analog clock, and I thought there was a dog sleeping at the foot of my bed (there wasn’t). So, while I won’t use the same intensity as werehatrack against oxycodone, I would urge everyone who might end up taking oxycodone for a legitimate reason to talk to your doctor(s) about disturbing effects. The way it took me out of the world around me makes me understand how it could be psychologically addictive.

In other semi-related Amazon news

Ghods help a China shipper whose containers are on the water now with a US arrival slot of May 2nd or later. I’m expecting some importers to silently evaporate into the ether as the tariff date approaches, possibly even if they’ve paid up front for the goods.

This entire mess is sheer lunacy.

@tinamarie1974 WHOA!

@werehatrack in a big bit of NIMBY, I do worry manufacturing will be brought back to the Western hemisphere in a large scale. Back when there were car and rubber plants in middle America, there was also soot and dust everywhere.

Thank you meh community for your informed input in this topic. It pretty much bears out what I had puzzled out on my own. It’s nice to see people who know what they’re talking about addressing these issues.

BTW, I intentionally kept this topic apolitical.

The latest updates, incase anyone is interested. I received this email earlier today

Tl:Dr don’t buy anything from Alibaba or Temu, etc. You will be buried in fees.

On top of that I’ve seen communications from FedEx and USPS that they are not accepting non business to business packages from China/Hong Kong to the US because of the additional workload to file entry.

++++++++++

Under a series of Executive Orders—primarily EO 14256, and its amendments—the United States has revoked the de minimis exemption (i.e., duty-free treatment for shipments valued at $800 or less) for certain products from China and Hong Kong.

Effective May 2, 2025, shipments that fall within the scope of Executive Order 14195 (as amended) and are valued at $800 or less:

Will no longer qualify for duty-free de minimis treatment Must be formally entered with (CBP) using Entry Types such as 01 (formal entry) or 11 (informal entry) Cannot be cleared using Entry Type 86 (ET86)

This applies to all modes of transportation, including express courier, air cargo, truck, ocean freight, and international mail.

Specific Impact Areas

ACE Filings Now Mandatory

All affected shipments must be submitted through CBP’s Automated Commercial Environment (ACE).

Paper-based entry submissions will not be accepted (except for international mail, which follows a separate protocol).

International Mail Shipments from China/Hong Kong

If you are receiving goods via postal mail from China or Hong Kong:

These packages will no longer enter duty-free. Duties will apply as follows: 120% ad valorem duty, or A flat fee of $100 per shipment (increasing to $200 starting June 1, 2025) Postal carriers will be responsible for collecting and remitting these duties to CBP.

CBP System Messaging & Rejections

Shipments filed incorrectly under de minimis rules will trigger rejections or error messages within ACE.

Importers or filers must take corrective action to ensure compliance and avoid delays at the border.

@tinamarie1974 Maybe this will weed out a lot of the who-the-heck-are-they third-party sellers of junk on Amazon.

@ItalianScallion and Etsy!!!

@ItalianScallion @tinamarie1974 If it’s just China and Hong Kong, what’s stopping companies from relaying packages through another country?

@narfcake @tinamarie1974 I’m thinking they would have to intentionally misrepresent/mislabel country of origin on the goods to avoid the China/Hong Long tariffs. Shipping via another country would likely avoid the fine-toothed-comb inspection applied to packages from China and Hong Kong, so some companies might think it’s worth the risk.

That reminds me of the Chinese honey fraud that happened about 20 years ago. Huge shipments of honey from China were refused entry to the US because of the presence of an illegal-in-the-US chemical that was used for pest control in hives in China. That honey went back and was then “ultrafiltered” to remove all traces of any chemicals, along with a lot of the flavor, then shipped back to the US via another country to avoid further scrutiny and labeled as being produced in that other country. The stuff was awful, I heard from other beekeepers, and more like corn syrup.

@ItalianScallion @narfcake they can if they have the infrastructure to do so. They would still be liable for whatever duty/tax is levied from the alternative country, but not st the exorbitant CN/HK levels.

@tinamarie1974 USPS sent out instructions on how to collect customs duties to employees this week. A couple minor changes but basically a reminder to look and get the money.

It is going to be interesting. I think there will be many refused packages and confused people. Not looking forward to explaining and being the messenger.

@speediedelivery @tinamarie1974 So with USPS, is it going to be like the old COD where the postal carrier is the one who collects the payment due and won’t deliver the package unless it’s paid?

@ItalianScallion @tinamarie1974 You will get a notice to come pick it up. The plan is not to send it out with the carriers.

@speediedelivery I feel sorry for anyone involved.

@tinamarie1974 Have you seen anything about creative pricing schemes, like the product is free just pay shipping? Saw an ad and it got me thinking about how the cost would be determined. I know this was a thing on eBay until the cost structure changed.

@speediedelivery not from reputable sources.

That said, it is well known that the Chinese Govt subsidizes product sales, and has for a long time; they allow mfgs to sell below cost and then secure a rebate after product is exported. I cannot imaging them being able to subsidize at full price (allowing zero cost sales), but who knows any more

The other thought, is the flat fees being charged regardless of value are rather prohibited.

I see lots of refused packages in carriers future.

@tinamarie1974 I’m curious what would happen regarding tariffs if a package is refused? If the package goes directly from the source in CN/HK to a regular person instead of through an importer and is refused, are tariffs still due and who would pay them?

@ItalianScallion if the importer refuses to pay, if I recall…the shipment is seized and destroyed or possibly auctioned off.

But its been about 20 yrs since Ive handled/oversaw brokerage.

@tinamarie1974 Thanks. This could become a source of junk–I mean stuff–for merchants like Meh, don’t you think?

@ItalianScallion oh I didnt think of that!!!

Thanks for revisiting this thread and bring us up to date @tinamarie1974 !

Some scary info I received today on an industry web inarticulate

That was suppose to say webinar sorry!!!

@tinamarie1974 Ohhhh boy …

@tinamarie1974 But web inarticulate sounds a bit more catchy to me.

KuoH

@kuoh gotta love fat fingers + autocorrect

@kuoh @tinamarie1974

Yeah… the next 6 months will be very interesting!

@chienfou @kuoh agree. I may need to start drinking lol

@chienfou @kuoh

@tinamarie1974, I hope you don’t have a drinking problem.

@chienfou @ItalianScallion @kuoh not yet!!!

Yall might find this interesting

https://www.dhl.com/global-en/microsites-2-0/core/us-tariffs.html

@tinamarie1974

TM… thanks for the update…

@tinamarie1974 What I found most interesting in the DHL documents was that there are export tariffs imposed on US goods. I learned as a kid that the Export Clause in the Constitution prohibited export taxes, period. Apparently there are some who think that the Export Clause conflicts with the Import/Export Clause which leaves it all to Congress to decide (if I read it correctly), but Congress allowed the president to impose “temporary tariffs.” I can’t seem to find a straight answer as to the legality of export taxes/tariffs, even in that case.

@ItalianScallion so those are actually retaliatory tariffs imposed by China and Canada, paid by the importer. I am not sure why they published it that way, it is confusing.

@tinamarie1974 Huh, I never would have expected confusing.

The supplier of our main component has ceased production and shipping at this time.

This is going to be interesting.

@lisaviolet

Yikes!

@chienfou @lisaviolet This is only the beginning. I’m expecting (and hoping) people will share more examples of how the tariffs are affecting them. I’m more interested in learning how the tariffs are functioning than getting into politics.

@chienfou @ItalianScallion When we run out of stock on hand, we’ll be done. Unless something changes.

@chienfou @lisaviolet That sucks. That really, really sucks. And it’s all so unnecessary.

Latest update!!

https://www.reuters.com/world/us/us-court-blocks-trumps-liberation-day-tariffs-2025-05-28/

@tinamarie1974

Thanks for the update. I’ve always admired the work that the LJC does!